Legacy Investments

Let’s look at your entire investment portfolio.

Then let’s make it something meaningful.

TWM Select Equity Portfolios

Selecting individual equity positions requires a dedicated process specific to the portfolio’s goals. Teixeira Wealth Management offers three distinct select equity portfolios. These portfolios are actively managed and typically consist of 30-50 securities per portfolio.

- Alpha Equity Portfolio: Our flagship portfolio which utilizes dual investment strategies. The primary strategy is holding long term positions of companies who are highly capital efficient and provide a durable competitive advantage. Our secondary strategy is trading short term positions we feel we can profit from given current market conditions.

- Equity Core Portfolio: The strategy of this portfolio is owning positions of high-quality businesses expected to perform well throughout a full market cycle. This portfolio invests primarily in large cap companies providing attractive valuations, a history of solid performance, and strong upside potential.

- Total Return Portfolio: With a balanced approach, this portfolio focuses on capital preservation, income generation, and growth. This strategy is designed to have less volatility than the stock market and aims to reduce portfolio risk by diversifying across several low-correlation asset classes.

TWM Eagle Eye Portfolios

Just like eagles fly overhead surveying the entire landscape, our Teixeira Wealth Management Eagle Eye Portfolios provide our clients with broad market exposure and diversification over multiple asset classes. These portfolios are passively managed and are composed of cost-efficient exchange traded funds (ETFs).

- Aggressive Allocation Portfolio:

Target Equity Allocation: 90%

Target Fixed Income Allocation: 10% - Moderate Allocation Portfolio:

Target Equity Allocation: 75%

Target Fixed Income Allocation: 25% - Balanced Allocation Portfolio:

Target Equity Allocation: 60%

Target Fixed Income Allocation: 40% - Conservative Allocation Portfolio:

Target Equity Allocation: 45%

Target Fixed Income Allocation: 55% - Preservation Allocation Portfolio:

Target Equity Allocation: 30%

Target Fixed Income Allocation: 70%

Asset Based Insurance

Yes, specific types of insurance can be considered a legacy asset. And when they are structured properly, they can be very tax advantageous for the policyowner. Here are a few examples:

Whole Life Insurance: This is an exceptionally versatile asset. When built correctly, a whole life policy can provide many advantages like tax deferred cash value growth, tax free cash withdrawals, access to cash value loans, and a tax-free death benefit to your beneficiaries. And unlike IRA’s, there are essentially no age restrictions, income earning limits, contribution limits, or withdrawal requirements with whole life policies. Time is one of the biggest factors of whole life policies, which makes them ideal as a legacy strategy for parent and/or grandparent gifting to children.

Hybrid Long Term Care Insurance: This product is a combination of long term care insurance and life insurance. Should the need arise for long term care, you would receive tax free benefits to pay for the costs associated with long term care. If you don’t trigger the need for LTC, you have access to the cash value of the policy that grows tax deferred. Another tax advantage of the policy is the death benefit is tax-free to your beneficiaries. These policies can help keep an estate intact in multiple ways.

Lifetime Income Annuities: There are multiple annuity options in the insurance marketplace. It’s so important to know the details of each type of annuity to make sure it’s meeting your specific goals. A deferred lifetime income annuity provides a guaranteed stream of income at a certain date in the future, which allows the policyowner to project what their potential income tax liability could look like at that time. These policies can also be designed to not only give you a lifetime of income, but also to a secondary annuitant.

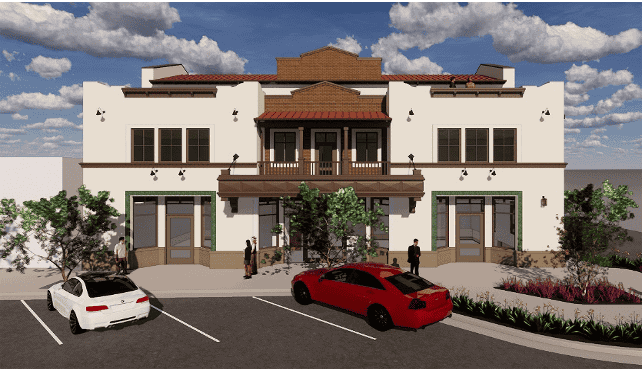

Private Equity Real Estate

Having real estate on your balance sheet is one of the best assets you can own for wealth creation and legacy building. That being said, it is very important to consider all of the factors and metrics that are associated with owning real estate.

How is it owned, what is the cap rate, what is the cash-on-cash return, what is your net operating income, what is your debt service ratio, what is the loan to value, how long do you plan on holding it, and how will it be managed are just some of the questions you need the answers to.

We are here to help you navigate and answer that gauntlet of questions and advise you on what properties you should own and which properties you should probably stay clear of.